Step 8: Lien Resolution

Q. DO I HAVE TO REIMBURSE MY INSURANCE COMPANY AFTER I SETTLE MY PERSONAL INJURY CASE?

A. Various entities may need to be reimbursed after you settle your personal injury claim, that is because of a legal principle called “subrogation.”

Q. WHAT IS SUBROGATION?

A. Subrogation is a legal principle that requires someone to be reimbursed if they paid medical bills or other benefits on your behalf, and then you collect money from a third party. For instance, if you have Medicare, Medicaid, or Worker’s Compensation, there are various federal and state statutes that come into play that afford these outside interests a claim to a portion of your settlement. Likewise, if you have a private health plan, or if you receive benefits for medical payments under your auto policy, then there is probably something in your insurance contract that requires you to reimburse your insurance company from your settlement. The amounts these entities are entitled to be reimbursed, will be based upon the terms of the contracts, as well as case law and state statutes that impose limits on the amount of money on subrogation rights.

Q. WHEN DOES SUBROGATION GET ADDRESSED?

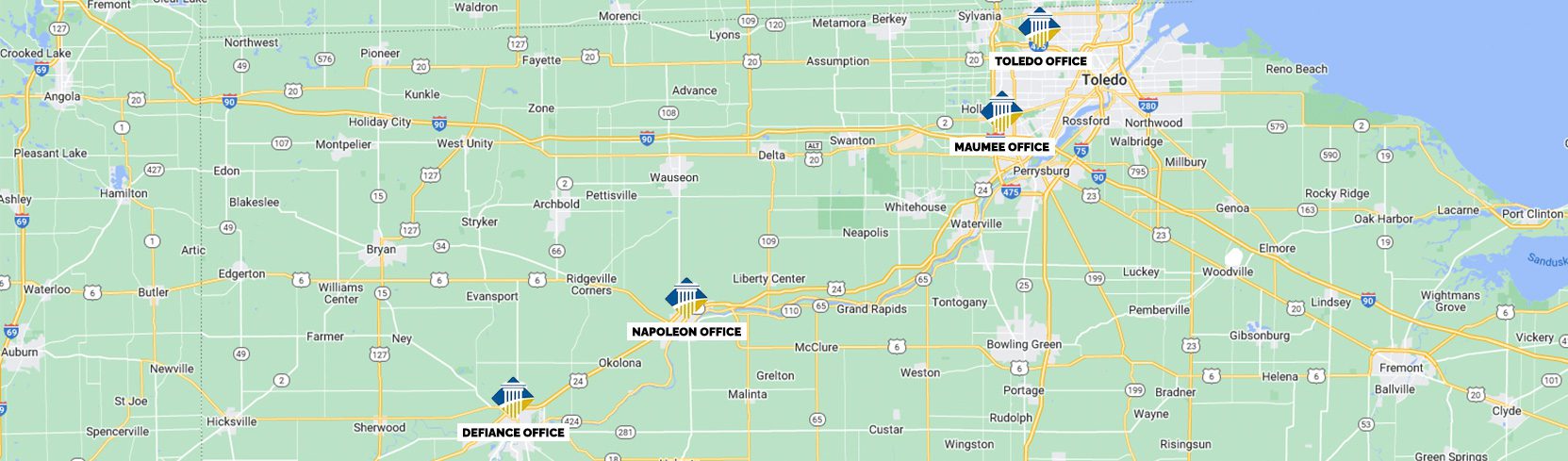

A. Almost always, subrogation is addressed once the amount of the settlement or judgment is determined. So subrogation is usually addressed at the end of the case. The lawyers at Arthur Law Firm have extensive experience with all types of subrogation claims, and our proven results over the course of several years, means at the end of the case, more money in your pockets.